-

-

Industry

-

-

-

-

Career Development

-

-

-

Everything you need to know about setting up and succeeding in Singapore

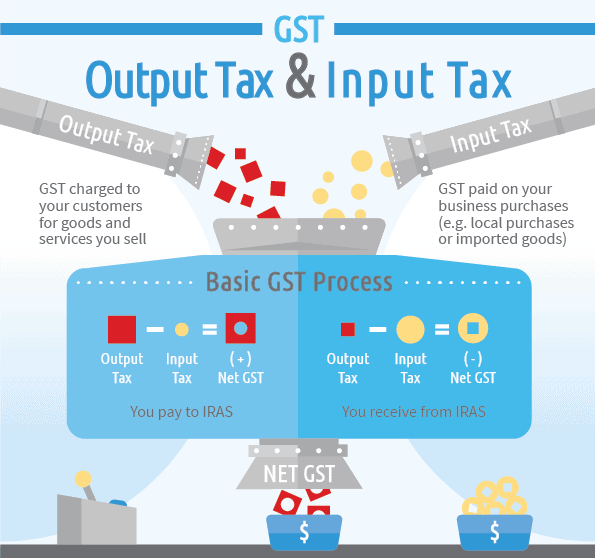

GST Computation

GST Computation

Taxable and Non-Taxable Goods and Services

The table below lists the categories and types of taxable and non-taxable supplies.

| Taxable Supplies | Non-Taxable Supplies | |||

|---|---|---|---|---|

Standard-Rated Supplies

(7% GST) | Zero-Rated Supplies

(0% GST) | Exempt Supplies

(GST is not applicable) | Out-of-Scope Supplies

(GST is not applicable) | |

| Goods | Most local sales fall under this category.

E.g. sale of TV set in a Singapore retail shop | Export of goods

E.g. sale of laptop to overseas customer where the laptop is shipped to an overseas address | Sale and rental of unfurnished residential property

Importation and local supply of investment precious metals | Sale where goods are delivered from overseas to another place overseas

Private transactions See Out-of-scope supplies for more information. |

| Services | Most local provision of services fall under this category. E.g. provision of spa services to a customer in Singapore | Services that are classified as international services

E.g. air ticket from Singapore to Thailand (international transportation service) | Financial services

E.g. issue of a debt security

Digital payment tokens (from 1 Jan 2020) E.g. exchange of Bitcoin for fiat currency | |

GST Formula

GST Due = Output Tax – Input Tax

Singapore FOZL Group Pte. Ltd.

Accounting and Corporate Regulatory Authority of Singapore licensed corporate advisory firm.

Singapore Company Registration, Annual Return, Accounting & Tax

Trademark Registration, Corporate Advisory, Serviced Offices.

6 Raffles Quay,#14-02- #14-06, Singapore 048580

Previous Page

Next Page

Relevant Knowledge

Singapore Office:6 Raffles Quay, #14-02——#14-07, Singapore 048580

Tel:+65 6717 0088

E-mail:marketing51@fozl.sg

Follow Us

Singapore 201101725E Germany DEB8536.HRB730998 Malaysia 202201006785 (1452482-W) China